Most adult children aren’t intimately familiar with their parents’ financial situation until Mom or Dad needs help managing finances or a child begins the probate process after a parent passes away. Unfortunately, seniors are experiencing more and more difficulty making ends meet on limited savings and income. Many either fail to pay their bills or turn to credit cards and payment plans to cover expenses. Family members often worry that they may be responsible for repaying these debts, but the good news is that they are not transferrable.

This is a common concern, but even if you have financial power of attorney (POA) for a parent, you are not liable for their debts. The only way these debts can be transferred to you is if you cosigned for them or are listed as a joint debtor. Depending on the situation, though, you might feel obligated to figure out a way to help a parent become debt free. There are a few different factors that play into how this can be done.

Get Acquainted with Your Parents’ Financial Standing

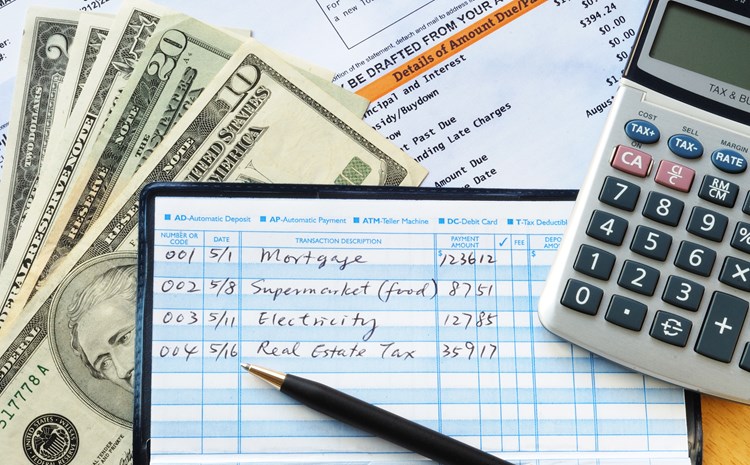

Money can be a difficult thing to discuss, especially with family members. But, it is important to address current and future financial issues early on. Failing to do so puts the entire family at a disadvantage. Even a general understanding of a parent’s income sources, expenses and liabilities can give adult children a head start when it comes to helping achieve solvency or administering an estate.

Learn as Much as You Can About Their Debt

Each type of debt carries a different degree of obligation or urgency for repayment. For example, it might be easier to deal with a credit card company in some instances than a local small business owner who really needs the payment for survival. But morally, you and your parent might feel differently about the order in which you need to settle these two particular balances.

It is important to consider the root source of these debts as well. Confusion over payment options and slick salespeople can often complicate financial matters. For example, is your parent paying for healthcare services using a credit card instead of working out a payment plan with the actual care provider? These institutions usually offer more favorable interest rates compared to credit card companies. When things are tight, inquire about all possible payment options to ensure you’re choosing the one that best fits your parent’s situation.

Taking steps to reduce future debts is another key factor in this process. Go through your parents’ records to determine if they are incurring any unnecessary expenses that are increasing their financial strain. For example, is some of the debt stemming from automatic charges or subscriptions for products or services that are no longer needed or affordable? Are the payments being made on time or incurring additional late fees? Getting a grip on automatic payments and reeling in spending will at least slow down the amount of debt your parent is accruing and hopefully free up some money to pay existing balances.

Each family’s situation is unique. Having financial check-ins with your parents early on will make a world of difference when the time comes for you to take over paying bills or settle the debts they left behind. This information will allow you to jump right in rather than muddle through financial statements and try to piece together the big picture on your own.

How to Reduce or Eliminate Debt

Getting rid of debt can be a long and arduous process, especially with minimal income and assets. Use the following tips and resources to make this endeavor as quick and affordable as possible.

- Ask the creditor if the payments can be lowered to better accommodate your loved one’s income.

- If your parent is a homeowner with low or no mortgage debt, is a reverse mortgage a viable option for supplementing their income? Just keep in mind that the loan becomes due once your parent dies or otherwise leaves the house.

- If your parent is experiencing a decline in cognitive function and you have been designated their financial power of attorney (POA), it is important to ensure your POA is effective and step in to help manage their money. This may include confiscating their credit cards and notifying creditors of their incapacitation. If your parent did not designate a financial POA, then you need to consider guardianship in order to safeguard their physical and financial wellbeing.

- If there are no assets available for repayment, write a letter to creditors notifying them of this and requesting debt forgiveness. (It is possible that the latter may only be granted after your parent qualifies for Medicaid.)

- Contact the Consumer Credit Counseling Service (CCCS) in your area for help with budgeting, debt coaching and tips on negotiating with creditors.

- If there are no available assets to settle these debts, bankruptcy can be an option, but be sure to hire an attorney to assist with this process. There are many legal action or legal aid organizations across the country that provide low or no cost counsel to low income individuals and the elderly.

How to Handle Debt After a Parent Has Passed

If your parent dies before you can get their affairs in order, your options may be limited because powers of attorney expire upon death. You’ll only be able to continue handling debts and financial decisions if you also happen to be named as executor of their will (or, if your parent died without a will, the probate court appointed you as authorized representative). With either of these designations, you will be responsible for collecting and managing your parent’s assets, settling debts, distributing personal possessions, filing a final tax return and paying bills.

Depending on the size of your parent’s estate, handling their outstanding financial obligations may be a complex process. State laws classify different types of debt into certain priority groups to help courts and executors identify which ones should be paid first. Using this order, you pay off what the estate has sufficient funds for and then write any remaining creditors notifying them that your parent has passed and their estate is insolvent (there are insufficient funds to cover their debts). As a personal example, when my mother passed away, she left behind more bills than assets. These letters worked just fine and we never heard from the creditors again.

When in Doubt, Seek Help

Financial matters are notoriously challenging, and things are even trickier when you’re trying to handle them on someone else’s behalf. If you have questions about any of the issues discussed above, it can’t hurt to consult an attorney, accountant or certified financial planner. These professionals can provide you with the answers you need to straighten out a loved one’s affairs.